As vehicle manufacturers announce plans to go all-electric by 2030, repairers and insurers are keeping a close eye on the changes taking place and adapting as necessary.

Mitchell International, Inc., an Enlyte company, recently released its inaugural quarterly trends report: “Plugged-In: EV Collision Insights,” which provides insight into the electric vehicle (EV) claims and market data and analyzes industry trends. EV sales in 2022 represented 5.6% of the market, according to Kelley Blue Book.

Ryan Mandell, director of claims performance at Mitchell, said the report will help carriers and collision repairers prepare as EV market growth continues and more EVs enter auto body shops.

“For the repair industry, additional training, tooling and equipment will be necessary considerations to meet the needs of these complex and interconnected vehicles,” the report said. “Automotive insurers, on the other hand, should be ready to examine underwriting practices so that they can meet the demands of a growing segment of the car parc with higher average repair costs and more complex repair procedures that must be performed to successfully deliver a proper and safe repair.”

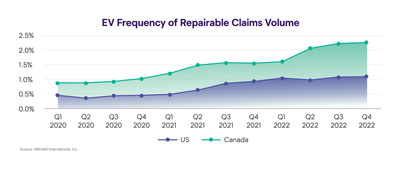

As of Q4 2022, EV repairable claims frequency was 1.1% in the U.S. and 2.26% in Canada, according to the report. The top North American EV markets based on repairable claims frequency were British Columbia (4.47%), California (3.37%) and Quebec (2.75%).

Autobody News reached out to Mandell to learn about the quarterly trends report, the data it includes and what it means for the industry moving forward.

What prompted the development of the quarterly EV report?

Mitchell’s previous trends report transitioned into an annual report when Enlyte, our parent brand, was formed in October 2021. We looked at opportunities to share insightful data that would be helpful for the greatest number of stakeholders---information different than they could find anywhere else.

The transition to EVs is a big disruptor, probably more so than anything we've seen in some time. We are seeing EV adoption numbers increasing and more coming into repair facilities.

It made sense to put out focused information about electrification and what it means for the industry. Insurers are asking how this transition will likely impact severity. That was something we knew we had to include.

We also wanted to demystify EVs and provide insights into what it means when these vehicles come into repair facilities. If you live in Southern California, you probably see EVs all the time, but if you are in another area of the country, you might not. A large section of the industry isn’t sure when they need to prepare for electrification, if they even need to, and if there is anything different with EVs. Whether or not people agree with the EV trend, people are buying them and it’s important to get prepared.

Our goal is to get information to carriers and shops, explain the market differences with EVs, and what to expect. The data shared is based on repairable estimates uploaded to Mitchell and we’ll continue to evolve the report.

Who is your main target audience?

It’s both insurers and repairers. Repairers are more on the front lines understanding some of the differences with these vehicles because they're living it firsthand. However, that's only in certain markets.

I work with many insurance carriers and the goal is to get them thinking about the EV business and how they will need to adapt their claims organization. An EV is a very different vehicle. They will need to think about the safety of appraisers in the field. They must understand how shops manage high-voltage batteries to ensure the safety of their teams.

What highlights can you share?

It was interesting to see how big of an impact Tesla has on the overall EV industry, with a 76.21% market share in the U.S. and 70.21% in Canada. When you look at that delta in terms of repair cost, it can be startling at first. But when you take Tesla out of that mix, it normalizes it a little more.

Teslas are complex and more expensive to repair. However, it’s not just the Tesla effect. Even without Tesla, you still have a significant delta in the repair cost for EVs because there’s more involved.

The number of mechanical labor hours on EV estimates still outpaces ICE vehicles with 1.7 additional mechanical labor hours, which was also interesting. That speaks to how you manage the high-voltage battery during the process. You have to isolate it in many instances, which often requires additional mechanical labor hours.

The other piece that stood out to me in the report was looking at the 27.45% average supplement delta for EVs and how much of a role that plays in the final cost of the repair compared to the original estimate. When you look at internal combustion engine (ICE) vehicles, that number is around 17%, so you're talking about 10 percentage points higher for an EV. That speaks to how critical OEM repair procedures are with these cars.

What is the main takeaway for repairers and insurers?

It’s important for insurers to look at the original estimate and forecast what the likely reserves will be for that claim and understand that it's probably going to be greater. When it comes to estimate writing, carriers and shops must be able to produce a collision damage appraisal that accounts for the differences between EVs and ICE vehicles. Once the estimate is written, there has to be a way for repairers to prioritize these vehicles and identify the damage quickly because there will be a more significant amount associated with them. The longer the claims process gets drawn out, the worse the customer experience is, which means CSI scores go down for the shop, the insurer and other stakeholders.

If there is a way to pre-scan during the initial estimate and focus on writing the most accurate estimate possible, it is a great way to add additional value to the process and get a better understanding of the systems that have been impacted.

The report states that 90.11% of U.S. and Canadian shops are using OEM parts. What do you attribute this to?

It’s the lack of availability of alternative EV parts. With ICE vehicles, OEM utilization is roughly 68% to 70%. That’s a big difference. There is a lack of cars in the salvage pool that are making it to auto recyclers and I think many are going overseas.

I believe the percentage of OEM parts utilization will change as the salvage pool increases and aftermarket manufacturers produce parts.

Can you share information about the percentage of parts repaired?

We found that the average percentage of parts repaired on EVs increased from 11.05% in Q3 2022 to 12.16% in Q4 2022. This suggests that repair facilities may be improving their capabilities to repair lighter-weight substrates. However, some of this increase may also have to do with ongoing supply chain disruptions and the lack of availability of replacement parts.

Shops are investing in technology, tools and equipment to repair some of these materials more effectively. Some of this is being driven by necessity because of the supply chain issue we're facing and the lack of availability of parts. Some shops are simply just repairing parts because they can't get a replacement.

To read a copy of the report, visit www.mitchell.com/plugged-in.

Stacey Phillips Ronak